Indicators Zone

Oscillators mt4 indicators

MACD 2Line MT4 Indicator

The MACD 2Line MT4 Indicator is a technical indicator used for trading forex and the stock market. It is an improved version of well well-known MACD indicator which displays histogram bars and …

trend indicators

MT4 Indicators, Trend Indicators

Trend Indicator LTFN for MT4

Trend Indicator LTFN indicator for MT4 is an easy to use popular forex trading indicator. Trend Indicator LTFN Indicator helps …

informational indicators

Informational Indicators, MT4 Indicators

Session Indicator MT4

The Session Indicator MT4 is a simple informational indicator for MetaTrader 4. The indicator draws boxes for Asian, London, and New York main trading sessions …

signal indicators

MT4 Indicators, Signal Indicators

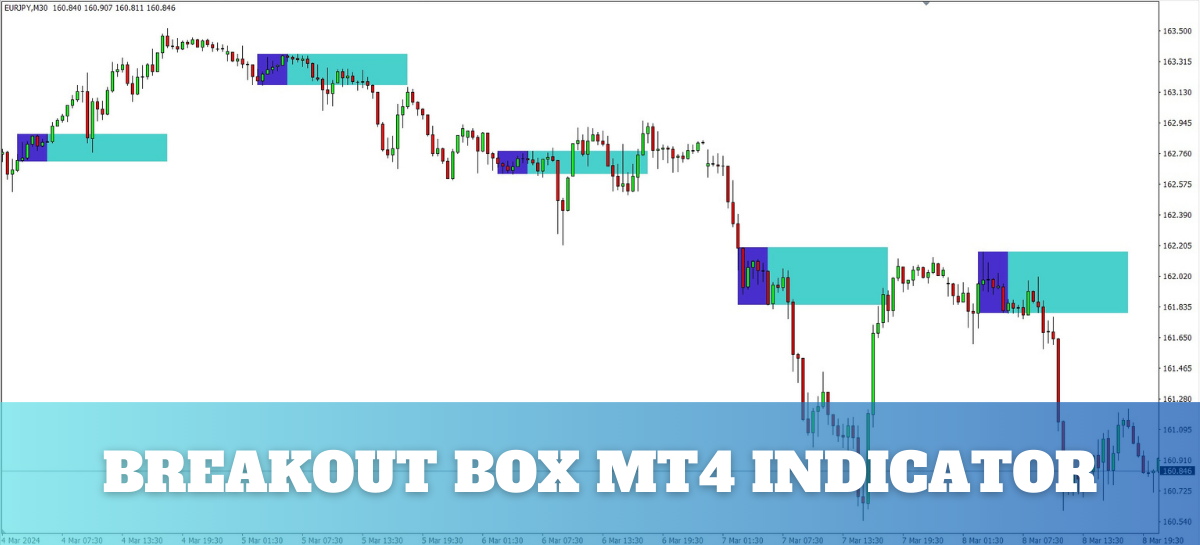

Breakout Zones MT4 Indicator

The Breakout Zones MT4 Indicator is a signal indicator. The indicator draws the breakout zones for you on the main chart. You may also …